If the turnover is high it indicates a combination of a conservative credit policy and an aggressive collections process, as well a lot of high-quality customers. A company should consider collecting on excessively old account receivable that are tying up capital, if their turnover ratio low. Low turnover is likely caused by lax credit policies, an inadequate collections process and/or a customer base with financial difficulties.

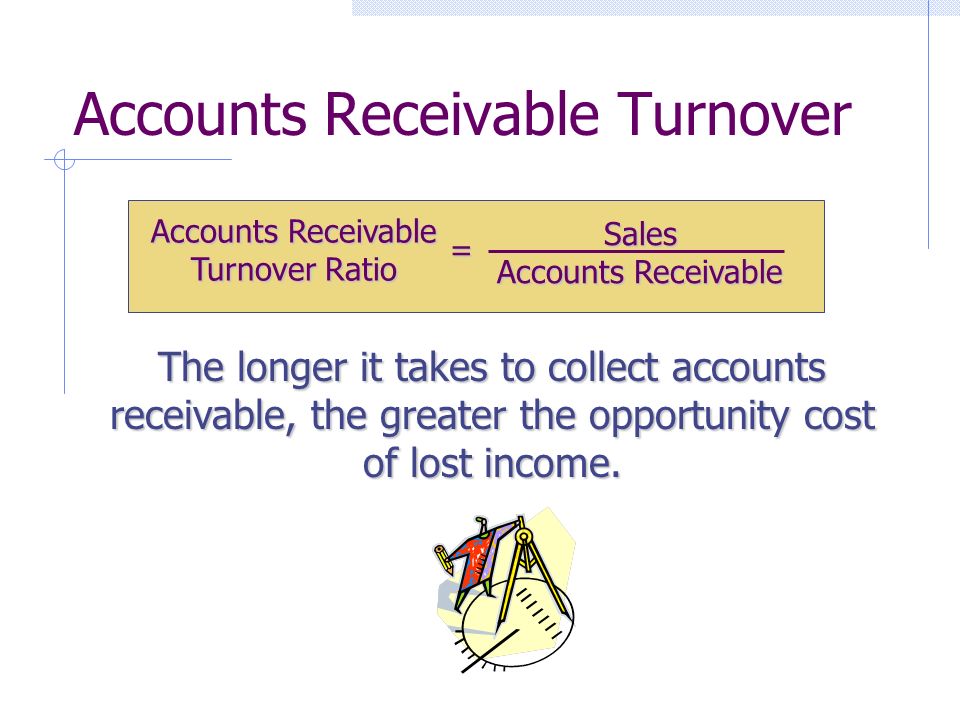

What is the accounts receivable turnover ratio formula?

- However, in examination problems, the examiners often don’t provide a separate breakdown of cash and credit sales.

- These professionals can help you manage your planning, policies, and answer any questions you have, about accounts receivable turnover, or otherwise.

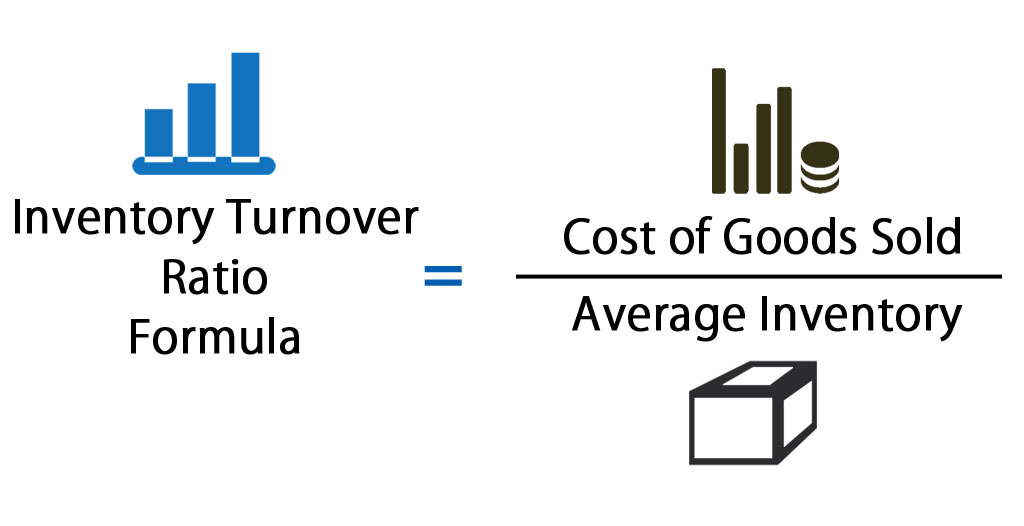

- Efficiency ratios measure a business’s ability to manage assets and liabilities in the short-term.

- The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance.

- A too high ratio can mean that your credit policies are too aggressive, which can lead to upset customers or a missed sales opportunity from a customer with slightly lower credit.

- This is usually calculated as the average between a company’s starting accounts receivable balance and ending accounts receivable balance.

Meredith is frequently sought out for her expertise in small business lending and financial management. However, it’s worth noting that a high ratio could also mean that you operate largely on a cash basis as well. Friendly reminders for payment don’t just need to come when a payment is late.

CREDIT CARDS

The two components of the formula of receivables turnover ratio are “net credit sales” and “average trade receivables”. However, in examination problems, the examiners often don’t provide a separate breakdown of cash and credit sales. In that case, students should use the total sales number as the numerator, assuming all the sales are credit sales. To provide a broad guideline, a receivable turnover ratio of around 5 to 10 is often considered normal or healthy for many businesses. However, it’s important to note that this can vary significantly depending on the nature of the industry.

Accounts Receivable Turnover Ratio – What does it mean?

A higher accounts receivable turnover indicates that a company is collecting payments from its customers more quickly. It suggests efficient management of credit and collection policies, as well as a healthy cash flow position. Using your receivables turnover ratio, you can determine the average number of days it takes for your clients or customers to pay their invoices. The accounts receivable turnover ratio tells a company how efficiently its collection process is. This is important because it directly correlates to how much cash a company may have on hand in addition to how much cash it may expect to receive in the short-term.

Low accounts receivable turnover ratio

The accounts receivable turnover ratio, or “receivables turnover”, measures the efficiency at which a company can collect its outstanding receivables from customers. The receivables turnover ratio is a liquidity ratio which measures how quickly and efficiently a company turns credit sales into cash. The canonical measure uses net credit sales (sales on credit netting out sales returns and allowances), but for companies which do most sales on credit using free proforma invoice template revenue will work decently as well. Congratulations, you now know how to calculate the accounts receivable turnover ratio. If similar business topics are of interest to you, check out our current ratio calculator, which is used to measure the liquidity of a company, or discounted cash flow calculator, which is a method of a company valuation. They’re more likely to pay when they know exactly when their payment is due and what they’re paying for.

As long as you get paid or pay in cash, sure, the act of buying or selling is immediately followed by payment. In this example, the company would enter “250,000” in the calculator’s “Average Accounts Receivable” data field. This is a great way to increase this ratio as it motivates the clientele of yours to pay faster and be punctual for all future transactions resulting in increased revenue generation. Since industries can differ from each other rather significantly, Alpha Lumber should only compare itself to other lumber companies.

That’s because companies of different sizes often have very different capital structures, which can greatly influence turnover calculations, and the same is often true of companies in different industries. Accounts receivables appear under the current assets section of a company’s balance sheet. If you’re not tracking receivables, money might be slipping through the cracks in your system. Make sure you always know where your money is (and where it’s going) with these tips. Once you know how old your outstanding invoices are, you can work on it accordingly to increase revenue from them or also make a note of those who haven’t paid yet for further follow-ups.

The more accurate and detailed your invoices are, the easier it is for your customers to pay that bill. Billing on time and often will also help your company collect its receivables quicker. If you have a payment system for your sales, it is less daunting for your customers to pay smaller, regular bills than one large bill every quarter. Whether you use accounting software or not, someone needs to track money in and money out.

These entities likely have periods with high receivables along with a low turnover ratio and periods when the receivables are fewer and can be more easily managed and collected. It measures the value of a company’s sales or revenues relative to the value of its assets and indicates how efficiently a company uses its assets to generate revenue. A low asset turnover ratio indicates that the company is using its assets inefficiently to generate sales.

You can find the numbers you need to plug into the formula on your annual income statement or balance sheet. By monitoring this ratio from one accounting period to the next, you can predict how much working capital you’ll have on hand and protect your business from bad debt. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Accounts receivable are effectively interest-free loans that are short-term in nature and are extended by companies to their customers. If a company generates a sale to a client, it could extend terms of 30 or 60 days, meaning the client has 30 to 60 days to pay for the product.

In that case, you might reconsider your credit policies to possibly increase sales as well as improve customer satisfaction. This income statement shows where you can pull the numbers for net credit sales. The best way to not deal with Accounts Receivable problems is not to have accounts receivable.